How Much Should It Cost to Modernize Your Church Giving Solution?

Having a modernized church giving solution for your ministry is the right move, and more and more church leaders see the value in doing so. Many people rarely carry cash or checkbooks these days, which can negatively impact church giving since these are the only two methods of giving in a traditional “pass the plate” offering.

This leads to a situation where well-intentioned churchgoers become inconsistent givers who only give when they remember to stop at the ATM before church.

It’s time to move your church giving into the modern world. But in so doing, it’s essential to count the costs. By this time, there are dozens of competing church giving solutions, each with unique features — and expenses. So, if you’re ready to take the plunge, how much should modernizing your church giving solution cost?

How Much Should You Have To Pay?

Well, the short and easy answer is “nothing!” Some services charge initial setup fees (some as high as $500!) or monthly membership fees ranging from $15 to over $100 per month. They will explain that these fees cover the cost of whichever features their service offers and probably will couch it in terms of “customized service” or “branded apps” or the like.

But these upfront and ongoing costs are burdensome, and most ministries don’t need or use the features those fees are supposed to cover.

How to Avoid Unnecessary Charges

Example Givelify Fees

Some services, like Givelify, have no startup, monthly, or membership fees. Instead of charging hefty sums, they take a small percentage of each transaction.

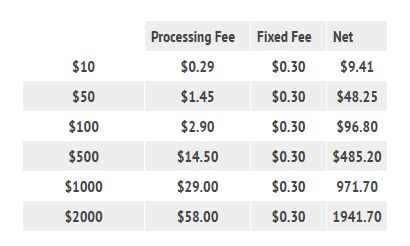

In the case of Givelify, the transaction fee is just 2.9% of the donation, plus 30 cents per transaction. That’s it – no matter what. It’s so simple!

For example, if your church receives a $100 donation through Givelify, this means Givelify would take just $3.20 (2.9% of $100 is $2.90, plus 30 cents).

You’re probably well aware of the stats that show how much giving tends to rise when churches enable a modern giving solution. This small per-transaction fee will feel like nothing when compared to those gains.

How Do They Handle Payments?

Another thing to consider in a church giving solution is how the company handles payments. Some companies hold all funds provided through their platform until the total reaches a certain amount. Others send invoices requiring manual payment of processing fees. Both of these could be more convenient and customer friendly.

Instead, Givelify deposits all donations within one business day automatically. Additionally, the fees are taken out before the funds are deposited into the church bank account. This frees church staff to focus on more meaningful tasks rather than tracking bills and making payments.

Lower Risk, Greater Reward

Maybe you’re still a little skeptical about modern giving solutions. With some of the expensive pricing models out there, your fears could be justified; if no one turns out to use online or mobile giving at your church, you’ll have spent a pretty penny to put the system in place for no good reason. But with Givelify, there is no risk. If no one in your church ever uses it, your church doesn’t pay a cent!

The vast majority of the time, the people in your ministry want to give to show their support. But many digital natives (and yes, many Millennials) are more accustomed to digital commerce than cash or check. Don’t let these people leave you behind!